Dynamics NAV have a very useful tool for accountants that will save you time and reduce efforts in creating repetitive and periodic journal entries. This is a standard NAV functionality in standard journals, however it’s rarely used and optimized by accountants.

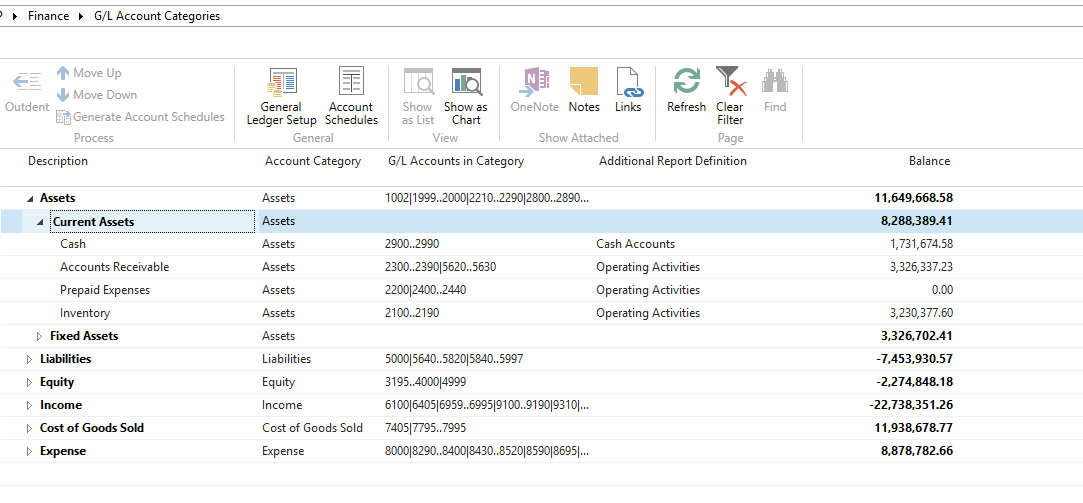

There is a handy new page which will give you an overview of all the categories. You can setup any new category, linking that to a predefined list of major categories, eg Income or Expense.

You can also see here how the system will maintain the range of accounts for you, for example it will know all prepaid expenses are in the range 2200|2400..2440

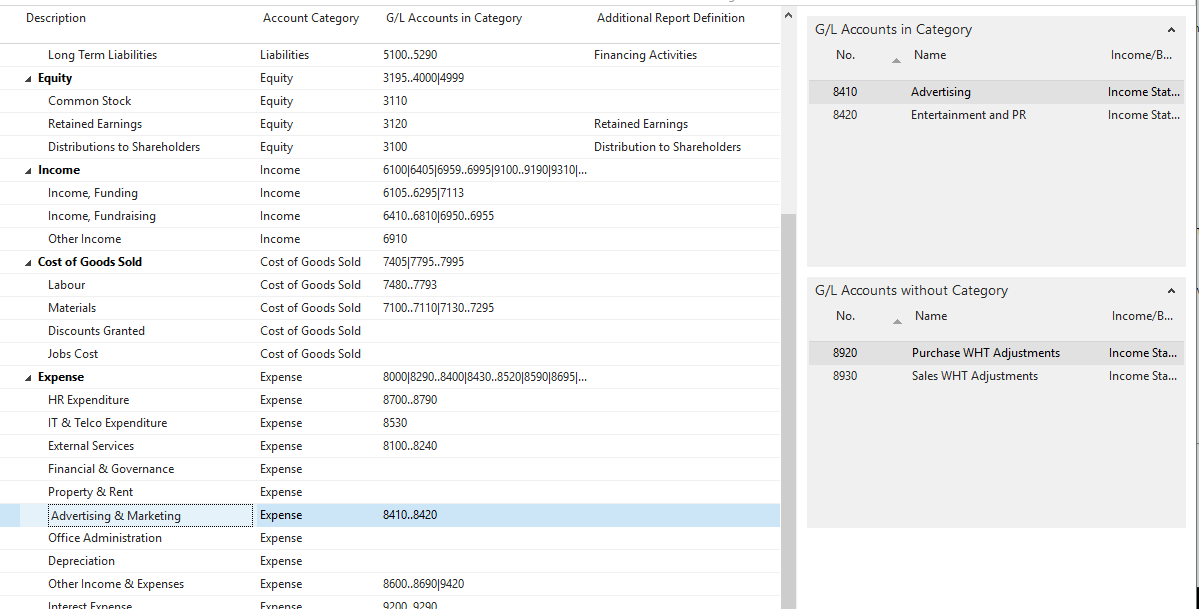

There is also a fact box on the right hand side which will clearly show any accounts missing a category and also the accounts assigned to the highlighted category. For example below, which G/L accounts are assigned to the Advertising and Marketing sub category. Then G/L accounts 8920 and 8930 are not assigned to a category.

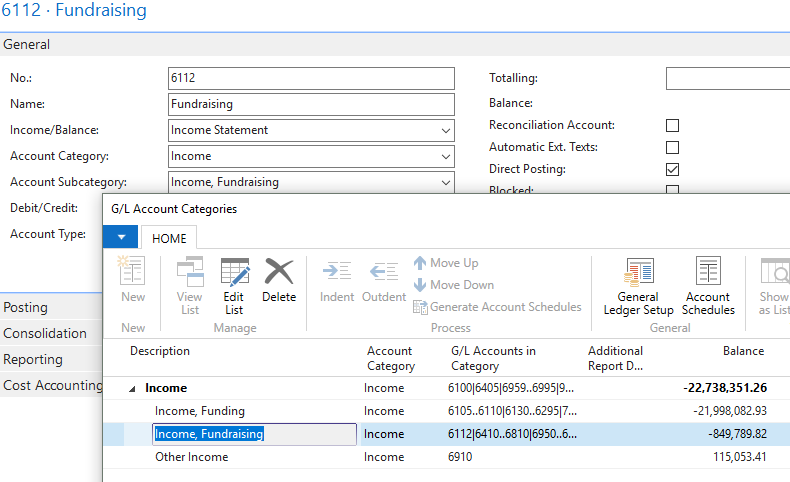

To assign a G/L account to a category, simply access the Chart of accounts page, edit the account and assign to the account category and sub category. For example, fundraising income.

Once the categories have been setup and all G/L accounts assigned, you can select to “Generate Accounts Schedules”.

The system will auto generate all of the account schedule rows to match the assigned groupings.

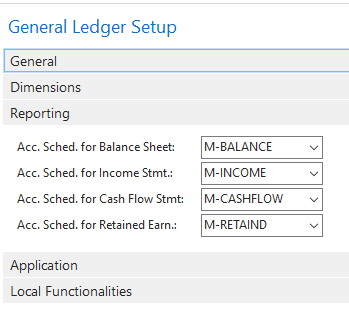

The general ledger setup reporting tab tells the system what accounts schedules will be system maintained. They all begin with “M-“ in the standard setup.

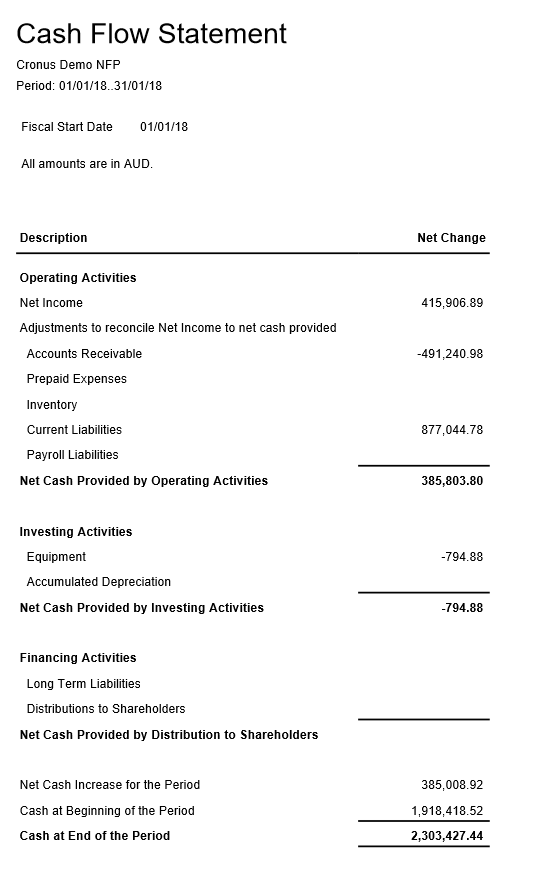

There is also the ability to assign “Additional Report Definition” which is used for Cash Flow reporting. So now NAV has a standard Cash Flow Statement report.

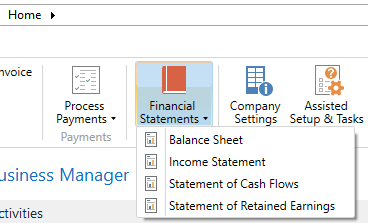

All of these reports can be accessed from the Business Manager role centre under Financials Statement. These four reports are running the matching account schedule reports.

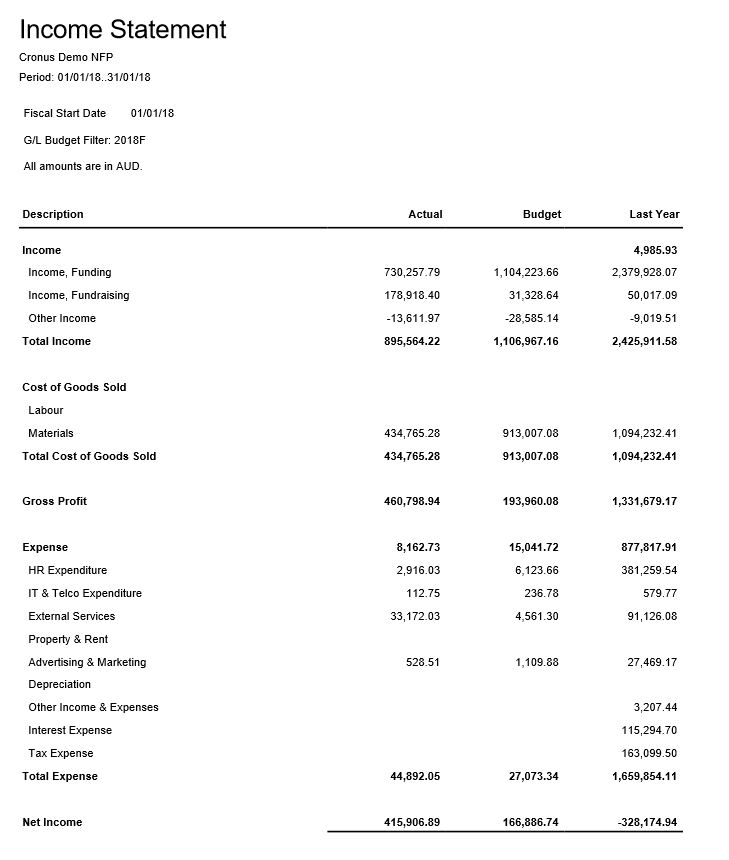

Below is a sample of the standard cash flow statement and Income Statement which was completely system generated without any need to build the account schedules.

Was this article helpful?

This post was written by Jonathan Martin, COO at Evolution Business Systems.

His expertise extends to software development, support, implementations and project management, he can envisage potential problems and identify them to improve the client experience and outcomes, like a mad scientist, behaviour, statistics and data are where he gets his insights from and lives by a golden rule to always start at the beginning as there are no shortcuts. Jonathan’s passion is to make a difference by assisting clients with their business problems.