In this blog, I will discuss how to dispose partial fixed assets in Dynamics 365 Business Central / NAV.

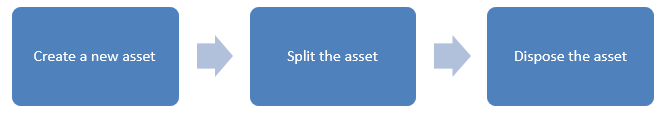

If you sell or dispose part of a fixed asset, prior to processing the disposal you will need to split the asset.

The following describes the process to dispose the partial asset.

Scenario

You have posted an acquisition cost for one asset in Business Central which is made up of two computers and now you want to sell one of the computers.

Action Task

You will need to split the asset into two assets: one asset having an acquisition cost of 50% of the total acquisition and depreciation amount, and the other one also having 50% of the total acquisition and depreciation amount. Then, use the FA reclassification journal to split one asset into two assets and keeping a part of it as the original asset. Followed by disposal fixed asset process.

Create New Fixed Asset

Create a new asset first before you transfer the acquisition and depreciation from old asset (FA000140) to new asset.

- Manually create a new fixed asset or use the Copy Fixed Asset function to create a new fixed asset by copying from an existing asset that has similar information.

- On the Fixed Asset page, select the asset that you wish to copy then go to select Actions > Copy Fixed Asset

Split the Fixed Asset

Use the Fixed Asset Reclassification Journal to split the posted acquisition cost and depreciation.

- In the Search box, enter Fixed Asset Reclassification Journals, and then choose the related link, or on Fixed Asset page, go to Action tab select Actions then select Fixed Assets Reclassification Journals.

- Create FA reclassification journal line to move 50% of the acquisition cost and depreciation of fixed asset FA000040 to FA000210.

- On the Action tab, select Reclassify and select Yes to confirm.

- Close the window (program will create the necessary line in the Fixed Asset G/L journal using the template and the batch that you specified in the FA Journal Setup window for the selected depreciation book).

- Go to Fixed Asset G/L Journal, open the journal and review the journal lines.

- Post the journal lines.

- Review the book value and posted FA ledger entries and GL entries to ensure that split up fixed asset is correct.

Disposal of Fixed Asset

You can use the Sales Invoice or FA G/L Journal to post disposal entry has G/L integration.

Option 1 – Post from Sales Invoice (require tax invoice)

- Create a new sales invoice as shown:

- Post the sales invoice, the system will auto calculate the Gain/(Loss) on disposal upon posting.

Option 2 – Post from FA G/L Journals

- In the Search box, enter Fixed Asset G/L Journal, and then choose the related link.

- Fill in the fields on the line.

- Post the journal lines, the system will auto calculate the Gain/(Loss) on disposal.

- Review the book value, posted FA ledger entries and GL entries to ensure that the FA disposal is correct.

Was this article helpful?

Katrine Ng is a Senior Solution Specialist at EBS and has a successful track record in project managing, implementing and delivering high-quality solutions. She likes to help customers translate their needs into business and user requirements. She has worked with Microsoft Dynamics 365 Business Central and Dynamics NAV in Australia and Malaysia since 2003.