To recognise revenues and expenses in different periods against a transaction posting period, Microsoft has presented a new feature in Dynamics NAV.

The purpose of deferral functionality is to automatically defer revenues and expenses over a specific period. This functionality is available on sales documents, purchase documents and general journal as well. The benefits of this functionality include:

* Reduce time and effort used to defer revenues and expenses after transactions are posted

* Easy reporting on deferred amounts for customers, vendors and G/L accounts.

How Deferrals work to the Period of Delivery?

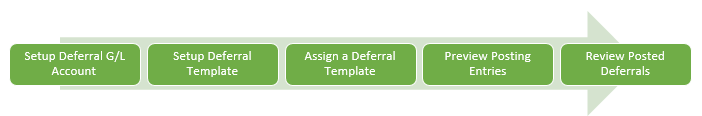

The following describes the process to distribute revenues or expenses over multiple accounting periods.

First, create a G/L account to which deferred revenues or expenses are posted. This needs to be a prepayment balance sheet G/L account.

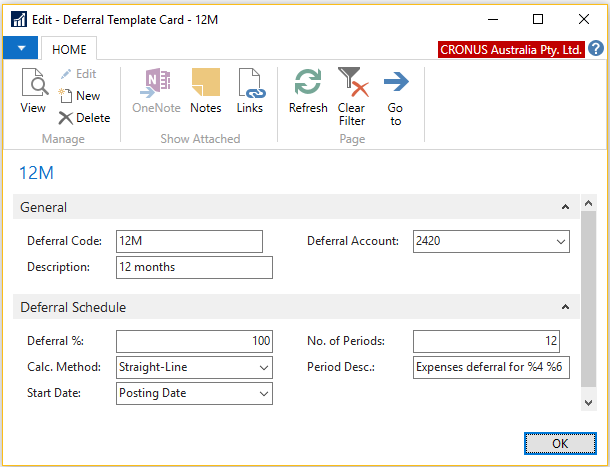

Then, create a deferral template to define the settings used to oversee the deferral schedule for a document.

Deferral Code – Identify the deferral template

Description – A brief description of the deferral template

Deferral Account – Specify the G/L account that the deferred revenues or expenses are posted

Deferral % – Specify how much of the total amount deferred

Calculation Method – Specify how the Amount field for each period in the Deferral Schedule window is calculated

Start Date – Specify when to start calculating deferral amounts

No of Periods – Specify how many accounting periods the amount will be deferred

Period Description -Specify the description

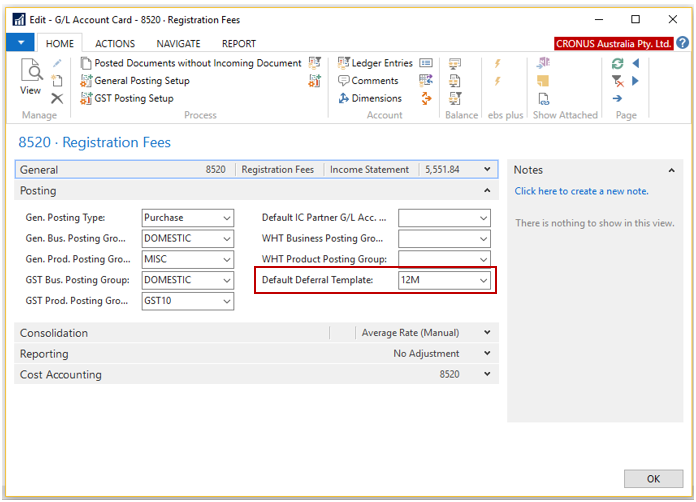

The user has a choice to assign a default deferral template to G/L Accounts, Items and Resources (use G/L Account as an example).

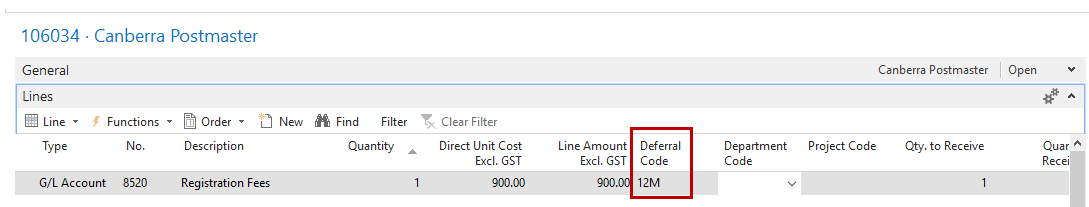

So, when the G/L Accounts, Items and Resources are selected on the document, the default deferral template will be automatically assigned on the line (use Purchase Order for example).

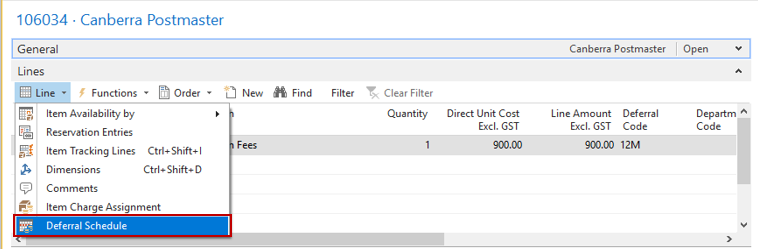

The user can view or modify the deferral schedule created from the template. On the Line FastTab, select Line then select Deferral Schedule.

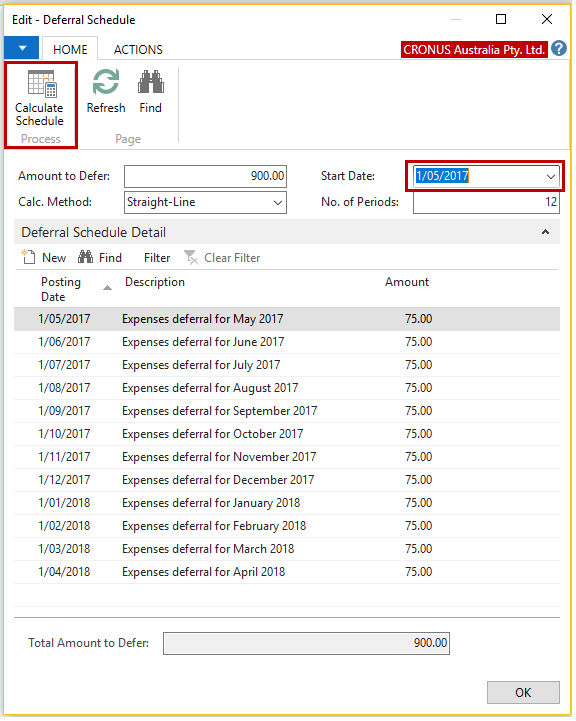

In the Deferral Schedule window, you can either change the setting or re-calculate the schedule with a new setting or directly amend the schedule lines (change the Start Date for example).

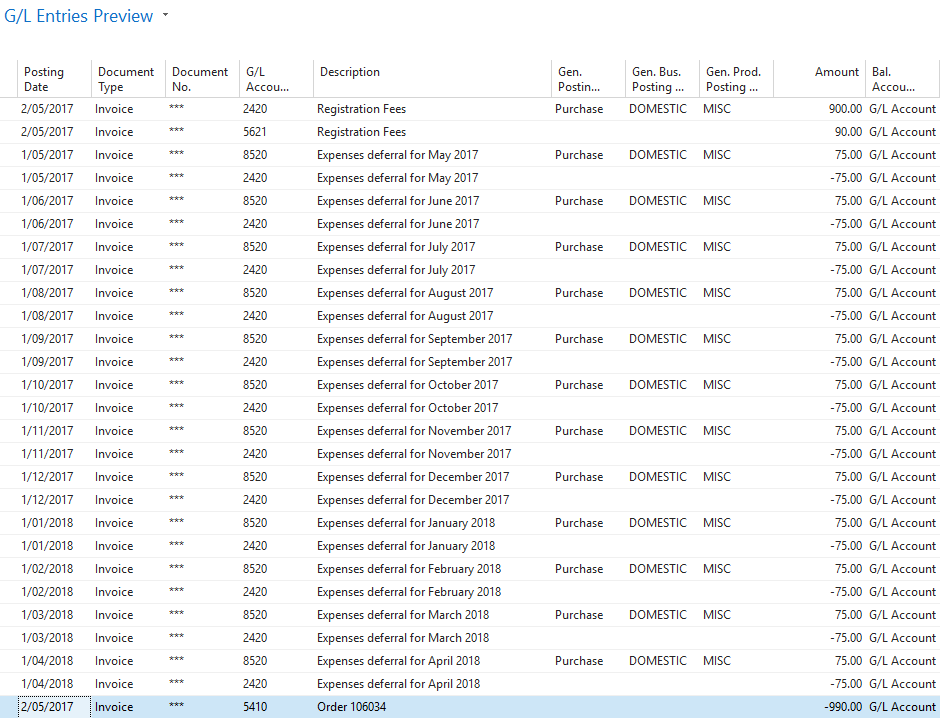

Prior to posting the document, you can preview how deferred expenses post to General Ledger as per below example.

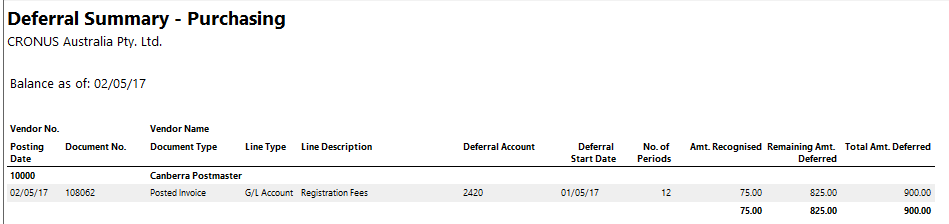

Once posted, you can review the posted deferrals in the Purchasing Summary report.

Deferral Reporting

The following reports provides a summary of deferred revenues or expenses:

* Sales Deferral Summary Report

* Purchasing Summary Report

* G/L Deferral Summary Report

For more information about Microsoft Dynamics NAV please call Paul Woods at EBS for an obligation free discussion on 1300 303 973.

Was this article helpful?

Katrine Ng is a Senior Solution Specialist at EBS and has a successful track record in project managing, implementing and delivering high-quality solutions. She likes to help customers translate their needs into business and user requirements. She has worked with Microsoft Dynamics 365 Business Central and Dynamics NAV in Australia and Malaysia since 2003.